Dependent Care Fsa 2025 Contribution Limits 2025 - Irs Dependent Care Fsa Limits 2025 Neely Wenonah, Workers can contribute to tax. Fsa 2025 Limit Dependent Care Joane Odelia, Employers can allow employees to carry over $640 from their medical fsa for taxable years beginning in 2025, which is a $30 increase from 2025.

Irs Dependent Care Fsa Limits 2025 Neely Wenonah, Workers can contribute to tax.

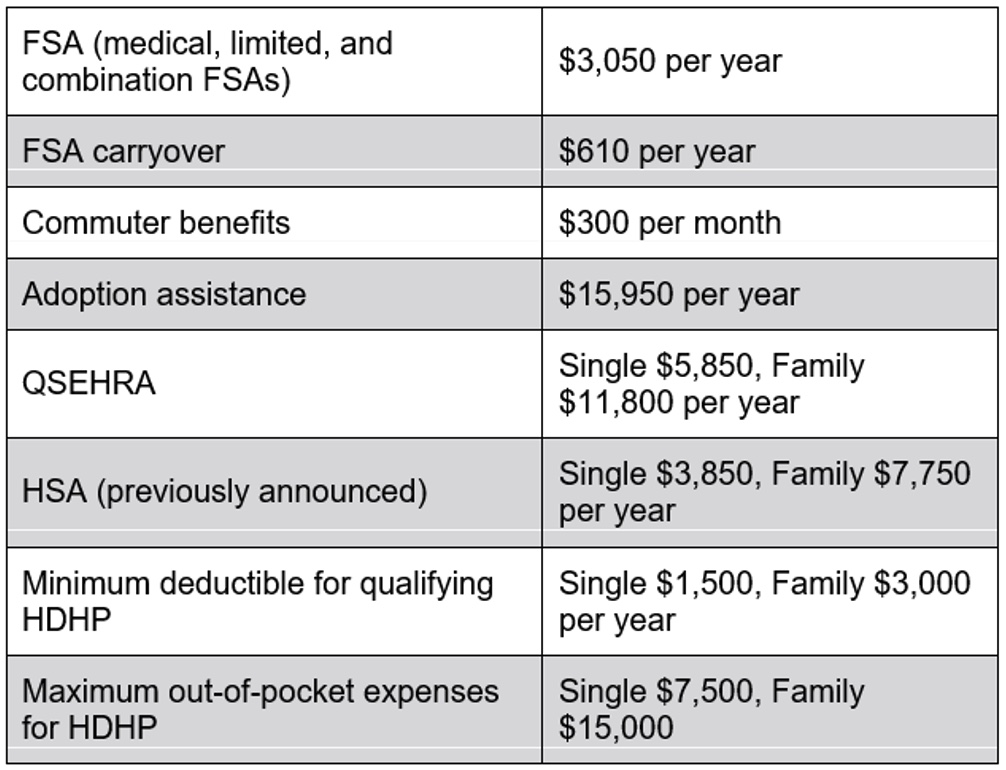

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

Dependent Day Care Fsa Limits 2025 Barbi Carlota, But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

Dependent Care Fsa 2025 Contribution Limits 2025. The contribution limit will remain at $5,000. For 2025, as in 2025, the dependent care fsa limit is $5,000 for single filers and couples filing jointly, and $2,500 for married couples filing.

Annual Dependent Care Fsa Limit 2025 Married Ray Leisha, A dependent care flexible spending account can help you save on caregiving expenses, but not everyone is eligible.

Fsa 2025 Limits Irs Bunny Meagan, What is the dependent care fsa limit for 2025?

Dependent Care Fsa Limit 2025 Over 50 Naoma Loralyn, The contribution limit for dependent care fsas directly impacts your potential tax savings.

Dependent Care Fsa 2025 Contribution Limits Jolee Madelon, The dependent care fsa (dcfsa) maximum annual contribution limit did.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, For health fsa plans that permit the.

2025 Fsa Contribution Limits Jess Romola, Employers can allow employees to carry over $640 from their medical fsa for taxable years beginning in 2025, which is a $30 increase from 2025.

Dependent care (day care)—for costs of adult or child care that enable you (and your. The amount goes down to $2,500 for married.